Focused Offerings

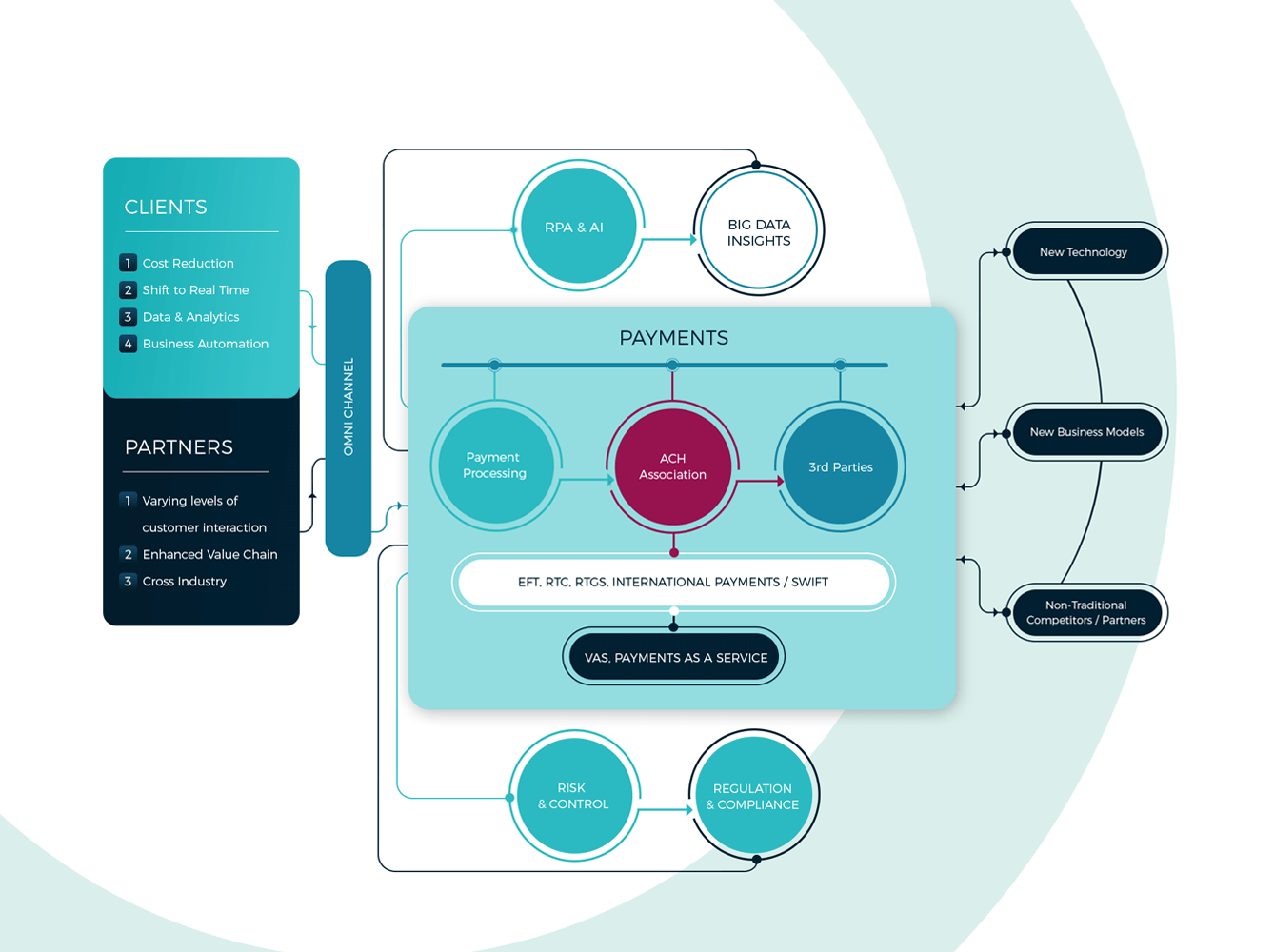

Payment providers need to consider all the factors driving payments, or run the risk of only being able to compete on price, diminishing margins and the risk of disintermediation

payment considerations in the digital world

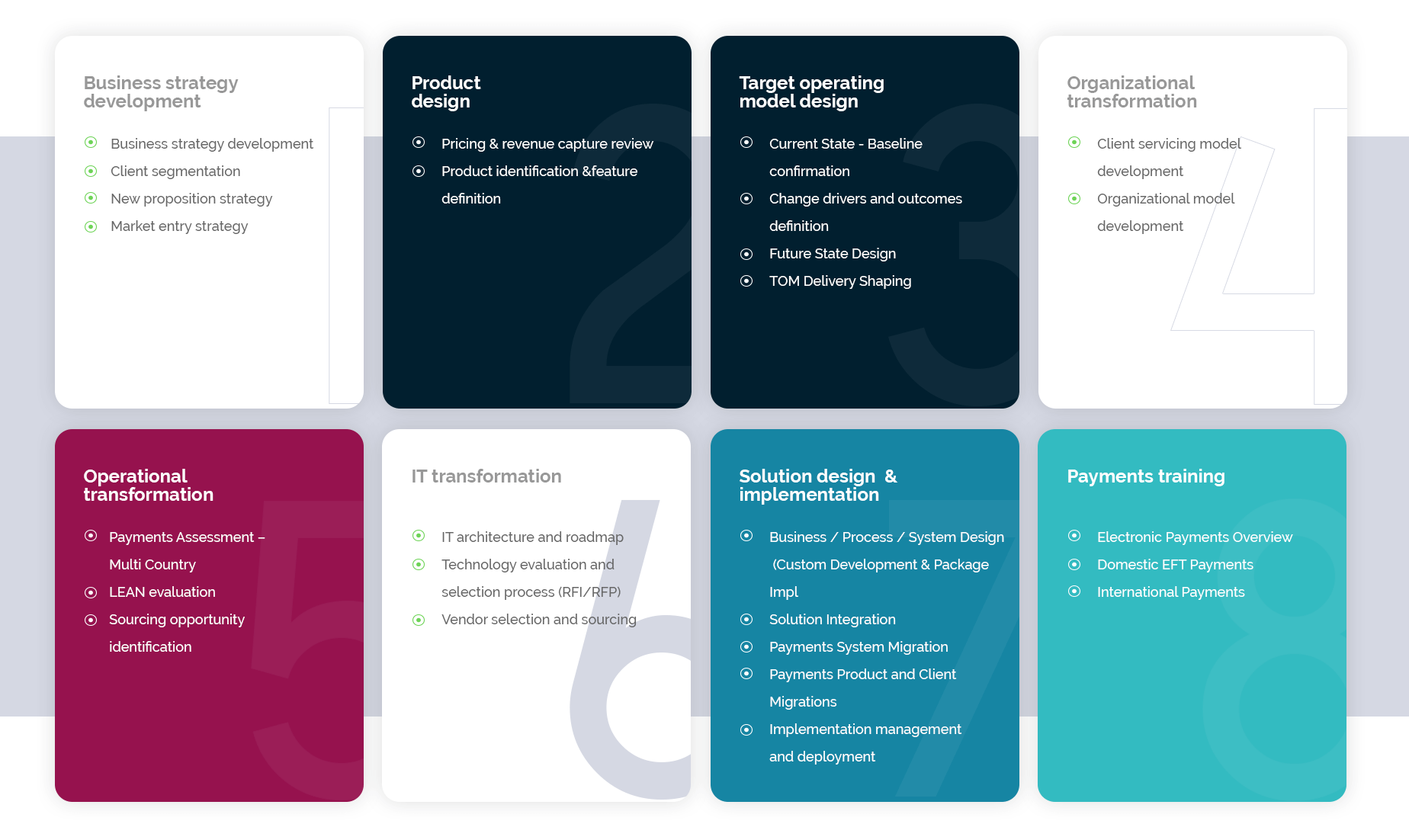

Ascent’s Payment Transformation capabilities

Our payments transformation expertise is a comprehensive consulting capability that provides a range of services that include payment health checks, business strategy formulation, target operating model design, and large-scale technology implementations, testing and roll-out.

- Business strategy development– business strategy development, client segmentation, market entry strategy, new product proposition.

- Product design– pricing and revenue capture review.

- Target operating model design and review– includes organisational transformation and IT transformation (IT architecture and roadmap).

- Operational excellence– includes payment health checks and operational transformation activities (process optimisation utilising a Lean Six Sigma approach and a sourcing model evaluation).

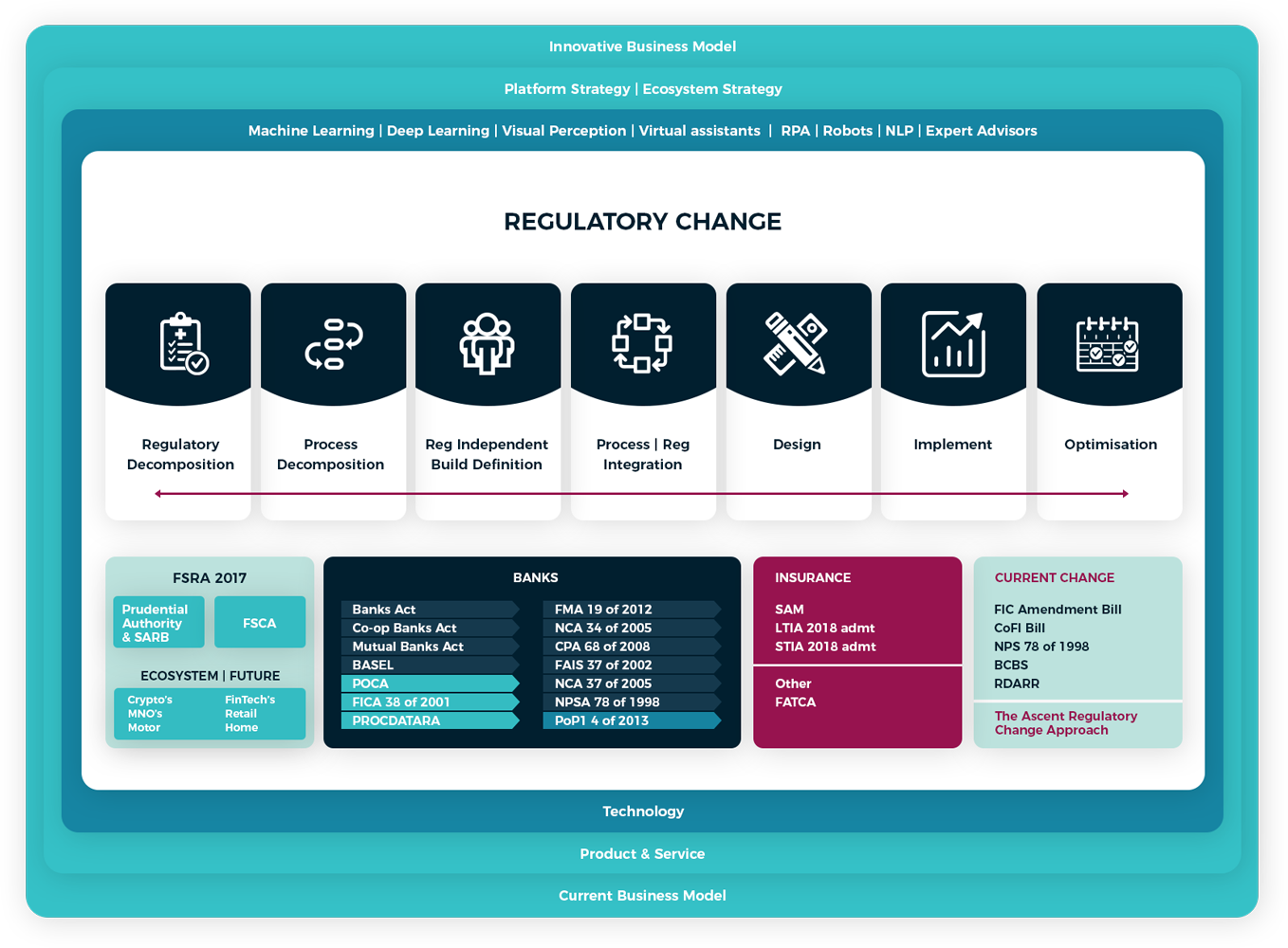

- Regulatory requirements – end to end approach that spans from regulatory/legislative change analysis to systems and business/process change design and implementation.

- Africa Payments – detailed subject matter expertise and experience in evaluating payments capabilities in various African countries, and assisting in the design, re-architecture, and implementation of core payments processing within those environments

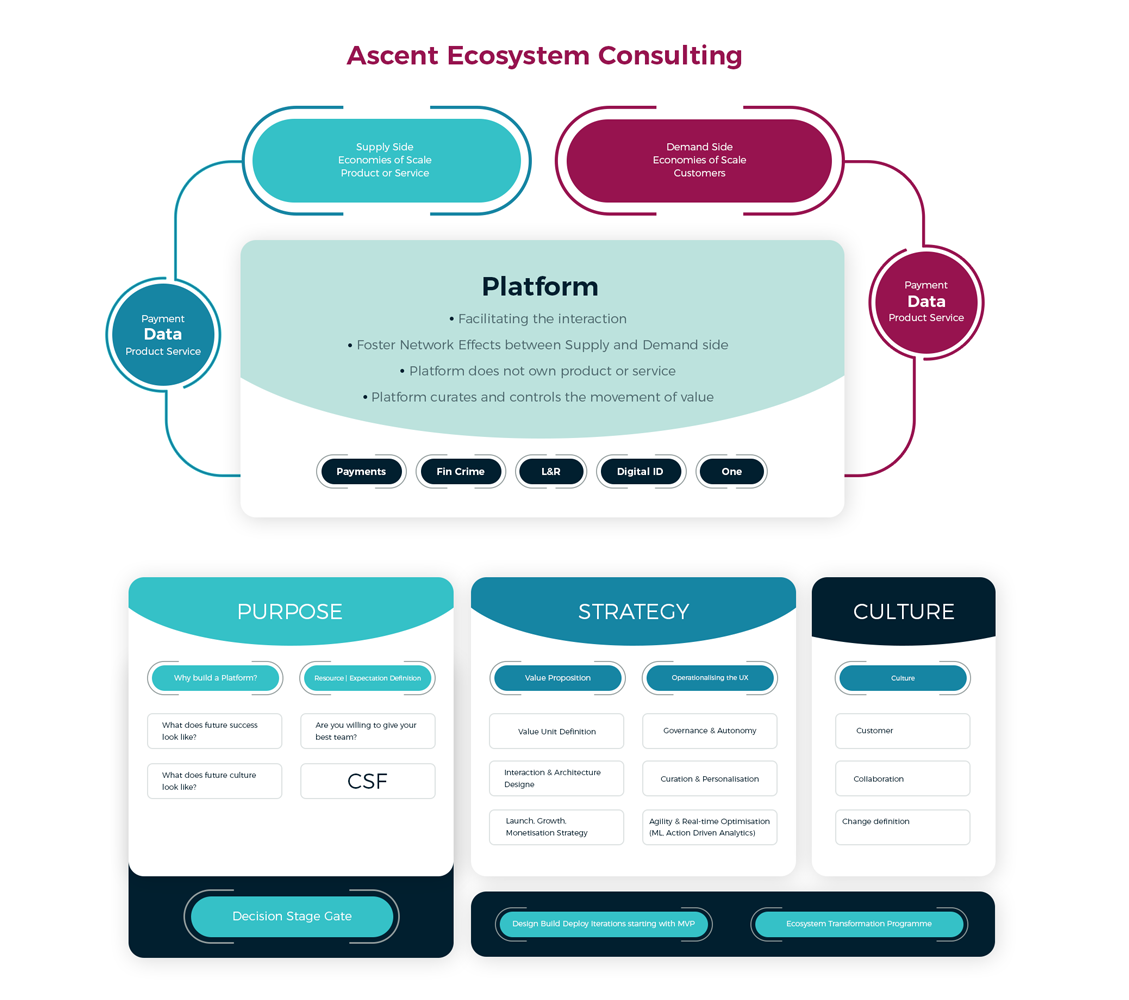

The real challenge occurs when business finds themselves simply digitize their existing business model, or unable to transition from their legacy business model to target.

Ascents Strategy and Multi Sided Platforms Capabilities

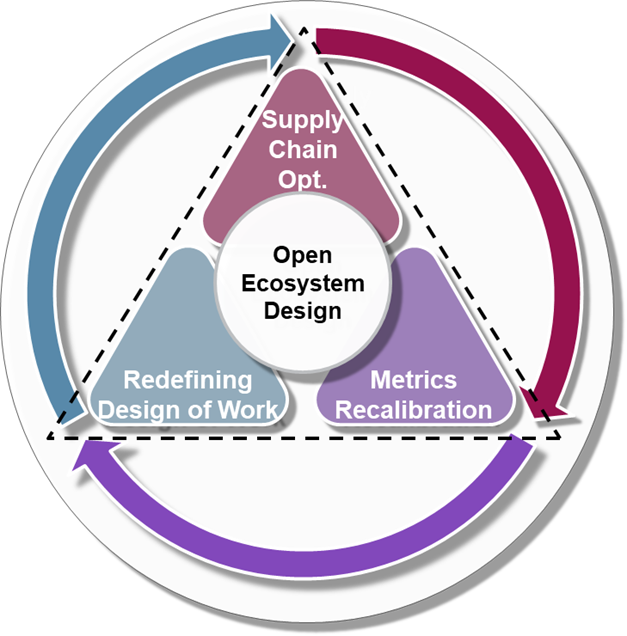

The Ascent Ecosystem Approach assists clients in progressing from strategy to execution, and provides a means for your organisation to design, test and transition the strategy and business to target state.

Risk & Compliance

ascent payments training

Payments Courses offered

Ascent Payments Training

The Ascent Payments Programme comprises a number of interlinking courses that serve to provide delegates with practical knowledge and experience on Electronic Payments. The design of the courses are modular in nature, and have been structured in such a manner that it is able to provide delegates with a comprehensive overview of the Electronic Payments industry and how it functions across payment types, as well as provide in-depth insight into each specific payment type and its associated roles players, industry flows and nuances.

The courses are specifically structured to always progress participants from standard concepts, to more complex variations and other concepts, while always ensuring a comprehensive end to end view is provided across all role players in the life cycle. The course further provides insight into some of the variations of these payment concepts across geographies, and the associated implications for the various role players.

The Ascent Payments Programme extends beyond the theoretical approach to Payments terms and concepts, and focuses on an actual understanding of the payments industry, how it practically works and what you need to be aware of when designing, or running, a payments organisation.

the ascent insurance accelerator

There is a continuous discussion on the significant structural change in the Financial Services Industry. Globally it appears that the insurance industry has been slow to respond to the growing threat from technology and in general is falling short of consumers increasingly high expectations.

Traditional short-term insurers are facing tremendous pressure in a low growth market where customer expectations remain high by world standards, while loyalty is on the decline as a result of lower price tolerance – customers are not willing to pay more for their current offering. Latest South African Customer Satisfaction Index for Short-Term Insurance shows that customer satisfaction is declining and smaller niche players are making big inroads into traditional markets.

Ascent Insurance Accelerator

Accent provides a 3 staged mechanism for organisations to more effectively address customer needs in the immediate term, while positioning themselves within a broader ecosystem to leverage new revenue opportunities, cost savings and enabling the transition from legacy to target state

Average years in financial services

Tier 1 institutions

Individuals trained on payments

Project categories

African countries

Contact us